Whoa!

DeFi on BNB Chain moves incredibly fast and it can feel chaotic sometimes.

New BEP‑20 tokens appear daily, promising high yields and clever utilities.

Initially I thought most users simply chased APR with little scrutiny, but looking at on‑chain activity and source code made me rethink that—actually, wait—let me rephrase that: a surprising number of people do check contracts, but many don’t check deeply enough.

My gut said somethin’ felt off about a few launches I watched, and that instinct saved me cash more than once.

Really?

Yeah, seriously, the surface narrative is “trust the team,” though actually trust should be earned not assumed.

One reason: smart contract verification is the on‑chain equivalent of a public audit, visible to anyone who cares to look.

On one hand verification doesn’t guarantee safety, but on the other it dramatically improves transparency and lets you spot red flags faster.

I’m biased, but this part bugs me: token devs who skip verification are asking for blind trust—no thanks.

Hmm…

Practical tip: when a new BEP‑20 drops, pop open the transaction history and the contract page before sending funds.

Check for constructor code, ownership patterns, and whether source code has been uploaded and matched to the deployed bytecode.

It sounds basic, yet many trades are made without those two minutes of verification, which is baffling to me.

Stuff like ownership renounce functions or hidden minting can be extremely telling.

Whoa!

I once tracked a token where the contract creator had a multisig address that was blatantly single key in practice, and the community didn’t notice for days.

That slipped past eager LP providers and resulted in a fast rugpull cleanup, although luckily for me I only watched the carnage from the sidelines.

On the technical side, verified source code gives you the function names and comments, while the bytecode alone is opaque—so verification lowers the barrier to understanding risk.

There are exceptions, of course; some teams purposely obfuscate for IP reasons, and that creates friction.

Really?

Yes—I mean it’s nuanced: verification is a tool, not a silver bullet.

Advanced checks include searching for delegatecall, owner-only mint functions, and suspicious event emissions that indicate hidden behavior.

At scale you can use heuristics and on‑chain analytics to flag risky patterns across many BEP‑20 tokens, though human review still catches weird edge cases.

My experience says a hybrid approach works best: automated alerts plus a quick manual audit for anything that matters financially.

Whoa!

One practical workflow I recommend is simple: verify the contract, scan recent transactions, review tokenomics, then check ownership and liquidity locks.

People often skip the ownership/renounce check, but that’s where many exploits start—owner can change fees, pull liquidity, or mint new tokens.

Liquidity pools without locked LP tokens are a red flag; conversely, visible locks on mainnet signals some commitment to stability.

Not infallible though—locks can be faked or misrepresented, so cross‑checking with verified contract functions and tx history is very very important.

Really?

Okay, so check this out—tools can help but you still need to know what to ask of the code.

For example, searchable strings and function selectors reveal if the contract uses OpenZeppelin libraries, which is usually a good sign if implemented correctly.

But copy‑pasting a template without understanding how ownership is set up can introduce glaring vulnerabilities.

My instinct said that template usage reduces risk but increases complacency, and sadly that’s often true.

Whoa!

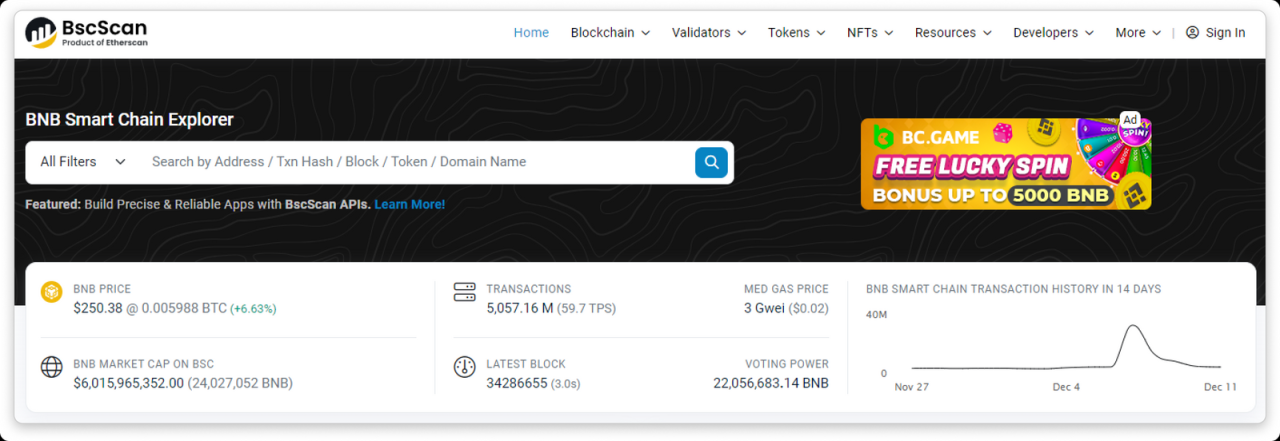

If you want to do this yourself, visit the bscscan block explorer and look up the token contract address.

The explorer will show whether source code is verified, list contract ABI, and provide a read/write interface to interact with functions directly.

Use that interface to check owner(), totalSupply(), and any custom functions that could change balances or fees—seeing is believing.

And yes, transaction timelines are gold: sudden token mints paired with transfers to exchange wallets or a single address can tell a story faster than cold code analysis.

Really?

Don’t ignore the community and on‑chain chatter either; sometimes developers leak intentions in Discord or Telegram, and cross‑referencing that with verified code prevents cognitive dissonance.

On one launch I followed, dev comments promised locked liquidity and audited contracts, but verification showed neither—so community noise can be misleading.

On the flip side, verified code plus a transparent roadmap builds confidence and fosters healthy liquidity provision—experience shows this repeatedly.

I’m not 100% sure every combo of signals will hold indefinitely, though, and that’s okay; risk evolves.

Whoa!

For teams: verify early and keep code clean, comment where it matters, and document ownership transfers publicly.

For users: make verification part of your checklist, automate what you can, and ask simple questions aloud when something seems odd.

On a larger scale, explorers and analytics build meta‑signals that help entire communities filter scams faster than manual policing ever could.

Something felt off a few times when I relied only on hype, so I now default to code first—the rest is noise.

Mục Lục

Final practical checklist

Really?

Alright, here’s a quick, usable rundown: verify source code, inspect ownership and LP locks, scan recent mints/transfers, look for delegatecall and external calls, and read community updates with skepticism.

Also keep a toolset: transaction viewers, automated scanners, and occasional manual reading of code—this mix covers most bases.

I’m biased toward on‑chain verification because it forces transparency, and frankly it’s less work than recovering funds after a rug.

So yeah—do the homework, ask questions, and don’t be afraid to sit out if somethin’ smells off…

FAQ

How long does verification take?

Typically a few minutes if the team uploads source code and matches the bytecode; if there are mismatches expect delays while they recompile or provide proof of provenance.

Does verification equal safety?

No—verification makes the code public, which is huge for transparency, but it doesn’t eliminate logic flaws or economic vulnerabilities; combine verification with transaction review and community due diligence.

TS.BS Vũ Trường Khanh có thế mạnh trong điều trị một số bệnh Gan mật như:

- Gan nhiễm mỡ

- Viêm gan do rượu

- Xơ gan

- Ung thư gan…

Kinh nghiệm

- Trưởng khoa Tiêu hóa – Bệnh viện Bạch Mai

- Thành viên Ban thường trực Liên chi hội Nội soi tiêu hóa Việt Nam

- Bác sĩ đầu tiên của Khoa Tiêu hoá ứng dụng phương pháp bắn tiêm xơ tĩnh mạch trong điều trị xơ gan mạn tính

- Bác sĩ Vũ Trường Khanh tham gia tư vấn về bệnh Gan trên nhiều kênh báo chí uy tín: VOV, VnExpress, cafeF…

- Các kiến thức về thuốc điều trị viêm gan hiệu quả