If the company suffered a loss last year, then its beginning period RE will start with a negative. An investor can make an idea through trend analysis whether the company is retaining its profit or its paying part of profits as dividends. what are retained earnings With Mercury, you can automatically track retained earnings, link them to your balance sheet, and make confident, data-driven reinvestment decisions. For a company’s after-tax earnings to become practical and facilitate comparisons across historical periods, including relative to its industry peers, the profit metric must be standardized. Once the company’s pre-tax income (EBT) has been reduced by its income tax expense, we’ve arrived at the company’s net income (the “bottom line”) for the given period.

Mục Lục

Comparing Net Income to Related Metrics

Finally, if either net income or shareholders’ equity is negative, the ROE number also becomes negative. A negative ROE is hard to interpret and should probably be ignored by most investors. Additionally, stock buybacks lead to reduced shareholders’ equity, so large-scale buybacks can increase ROE by reducing the equity part of the formula. For example, imagine a company had $5 million in net income in the year 2019. At the end of the year, the shareholders’ equity had increased to $11 million.

How to calculate retained earnings

This section details how much cash has been used to repay debt, issue shares, or distribute dividends. The balance sheet approach provides a way to estimate dividends when companies don’t explicitly report them. It’s a useful method for investors who want to assess how much profit has been returned to shareholders compared to what’s being reinvested into the company. The dividend payout ratio is an essential indicator of the company’s dividend sustainability and the balance between paying dividends and reinvesting profits.

Taylor Swift-Kelce wedding spikes global growth

Net income is often used in business valuations, especially for calculations like price-to-earnings (P/E) ratios. Plus, a healthy net income is a good sign to investors, showing that your business has a stable financial position and strong returns. This gives you a clearer picture of how efficiently your business is operating without factoring in how it’s financed or taxed. This is the amount your business has made after subtracting all expenses.

Section 2: Distinguishing Revenue from Retained Earnings

Of note, preferred dividends are subtracted before calculating the net income in the ROE formula. Return on equity is a financial metric used to evaluate a company’s efficiency in generating a profit. Investors can analyze return on equity to assess a company’s profit-making abilities.

- Once the company’s pre-tax income (EBT) has been reduced by its income tax expense, we’ve arrived at the company’s net income (the “bottom line”) for the given period.

- But there are instances where the net income is positive, but the retained income is still negative.

- For example, if the dividends a company distributed were actually greater than retained earnings balance, it could make sense to see a negative balance.

- Earnings per share (EPS) is the most commonly used metric to describe a company’s profitability.

- A history of lower retained earnings could indicate that the company is in a mature, low-growth stage since there are fewer ways for the company to reinvest its earnings.

- These reduce the size of a company’s balance sheet and asset value as the company no longer owns part of its liquid assets.

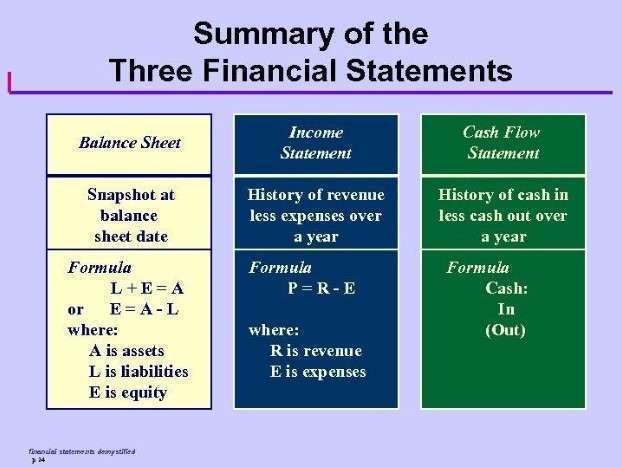

The income statement shows a time period, such as a year, while the balance sheet shows a snapshot of the time it was prepared. A high return on equity makes it attractive for investors to not only invest in the business but also retain money in the business instead of paying it out as dividends. In simple terms, ROE tells you how efficiently a company uses its net assets to produce profits. A high return on equity means that a company is good at producing profits, which could https://interpromote.com/massachusetts-accounting-tax-and-consulting/ then be used to grow earnings in the future. Booth’s fixed assets were used to only 50% of capacity during 2019, but its current assets were at their proper levels in relation to sales. All assets except fixed assets must increase at the same rate as sales, and fixed assets would also have to increase at the same rate if the current excess capacity did not exist.

- This is just a dividend payment made in shares of a company, rather than cash.

- The money that’s left after you’ve paid your shareholders is held onto (or “retained”) by the business.

- For our retained earnings modeling exercise, the following assumptions will be used for our hypothetical company as of the last twelve months (LTM), or Year 0.

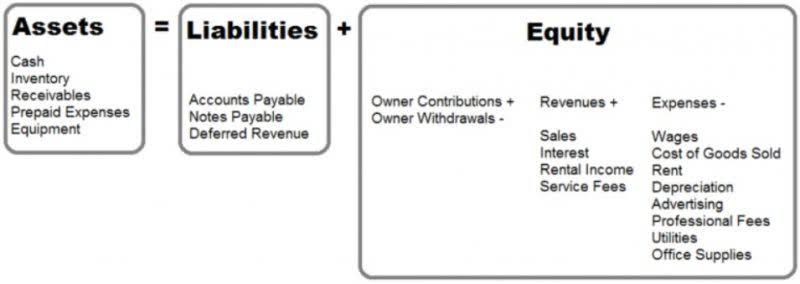

- Examples of these items include sales revenue, cost of goods sold, depreciation, and other operating expenses.

- This retained income is the amount companies use for reinvestment, which means utilizing the money back into the business.

- It starts with your beginning balance, adds net income, subtracts dividends, and ends with your closing retained earnings figure.

Your retained earnings account on January 1, 2020 will read $0, because you have no earnings to retain. We’ll pair you with a bookkeeper to calculate your retained earnings for you so you’ll always be able to see where you’re at. Retained earnings are like a running tally of how much profit your company has managed to hold onto since it was founded.

- Now your business is taking off and you’re starting to make a healthy profit which means it’s time to pay dividends.

- If you add up the most recent shareholders’ equity and the shareholders’ equity 12 months ago, then divide by 2, you will have the average shareholders’ equity.

- Net income is a handy benchmark for determining “How is my business doing?

- Dividend yield helps investors compare different dividend-paying stocks and assess whether the stock provides sufficient income relative to its price.

- If your business is seasonal, like lawn care or snow removal, your retained earnings may fluctuate substantially from one quarter to the next.

- To better explain the retained earnings calculation, we’ll use a realistic retained earnings example.

It starts with your beginning balance, adds net income, subtracts dividends, and ends with your closing retained earnings figure. Retained earnings might not sound exciting, but this balance sheet number tells one of the most important stories about your business. It shows how much profit you’ve kept in the company after paying all of your expenses, taxes, and dividends. In other words, retained earnings are the portion of your earnings that can help you build something bigger. The cash flow statement is linked to the balance sheet because the financial statement tracks the change in the working capital accounts, i.e. the increase or decrease in working capital.

Example Calculation

In simple terms, gross income (also known as gross profit or gross margin) is the total money you make from selling goods or services, before subtracting other expenses. Startups and smaller, growth-focused companies tend to have high retention retained earnings formula ratios. Large companies that are already profitable and comfortable paying dividends will have a lower ratio. While the retention ratio looks at the percentage of net income you’re keeping, the dividend payout ratio looks at the percentage of net income you’re paying out to shareholders. Company XYZ has reported figures for a three-month period ending February 28, 2025 (figures are in thousands of dollars).

TS.BS Vũ Trường Khanh có thế mạnh trong điều trị một số bệnh Gan mật như:

- Gan nhiễm mỡ

- Viêm gan do rượu

- Xơ gan

- Ung thư gan…

Kinh nghiệm

- Trưởng khoa Tiêu hóa – Bệnh viện Bạch Mai

- Thành viên Ban thường trực Liên chi hội Nội soi tiêu hóa Việt Nam

- Bác sĩ đầu tiên của Khoa Tiêu hoá ứng dụng phương pháp bắn tiêm xơ tĩnh mạch trong điều trị xơ gan mạn tính

- Bác sĩ Vũ Trường Khanh tham gia tư vấn về bệnh Gan trên nhiều kênh báo chí uy tín: VOV, VnExpress, cafeF…

- Các kiến thức về thuốc điều trị viêm gan hiệu quả