The percentage of sales method estimates bad debt expense based on a percentage of total credit sales, focusing on the income statement. In contrast, the aging of accounts receivable method estimates uncollectible accounts based on the age of individual receivables, focusing on the balance sheet. The aging of receivables method and the percentage of sales method are both used to estimate uncollectible accounts, but they differ in focus and approach. The aging of receivables method is a balance sheet approach that estimates uncollectible accounts based on the age of accounts receivable. It focuses on the ending balance in the Allowance for Doubtful Accounts. In contrast, the percentage of sales method is an income statement approach that estimates uncollectible accounts as a percentage of total sales, focusing on revenue.

Mục Lục

Account Receivable

For restaurant owners, profitability and how to measure it effectively are top priorities. To navigate these complexities, utilize software tools such as QuickBooks or Toast. These tools automate COS tracking, adapt to each business model’s differences, and reduce manual errors—freeing up time to focus on your bottom line. If you’re not sure if you can implement these tools on your own, hire a business consultant or a technical consultant to help you with the setup. Combining online ordering, loyalty, omnichannel messaging, AI insights, and payments in one suite. Paytronix delivers relevant, personal experiences, at scale, that help improve your entire digital marketing funnel by creating amazing frictionless experiences.

What COGS as % of Sales Means and Why It Matters

Businesses utilize the results of this technique to make necessary adjustments for the future depending on the financial outlook. That said, one must note that businesses cannot predict fixed using this tool. This \$30,000 represents the bad debt expense for the period and is recorded as a journal entry, debiting the bad debt expense account and crediting the allowance for doubtful accounts.

Step-by-Step Process to Calculate Percentage of Sales

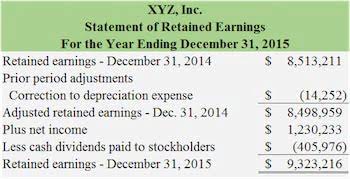

Credit sales carry a great deal of risk despite their convenience, including processing fees. Bad credit expense refers to purchases that go uncollected due to credit card complications on the customer end. If your sales increase by 20 percent, you can expect your total sales value in retained earnings the upcoming quarter or year to be $90,000.

What Is Bad Debt?

Employing the allowance method not only keeps your books GAAP-compliant but also ensures your balance sheet genuinely reflects your company’s worth. This builds trust with everyone invested in your business’s success. Bad debt expense appears as an operating cost on the income statement.

Say for example that Jim believes he can increase company revenue (sales) to $400,000 next year. For the percentage-of-sales method, you need the historical goods sold sales percentage and the other relevant percentages based on past sales behavior. Because the percentage-of-sales method uses common financial ratios and percentages, it’s a good tool for quickly comparing how a company is doing compared to its competitors or the wider market. By combining the percentage of sales method with other financial analysis techniques, companies can develop more robust and realistic financial plans. Liz’s final step is to use the percentages she https://cleaners808.com/accounts-receivable-insurance-for-global-business-4/ calculated in step 3 to look at the balance forecasts under an assumption of $66,000 in sales. Most businesses think they have a good sense of whether sales are up or down, but how are they gauging accuracy?

- Of these expenses, he sees that only the last two are tied to sales as they fluctuate.

- In many cases, exam questions may directly provide the ending balance derived from the aging schedule, simplifying the calculation process.

- Either net sales or credit sales method is acceptable in the calculation of bad debt expense.

- Read our ultimate guide on white space analysis, its benefits, and how it can uncover new opportunities for your business today.

- This simple yet powerful calculation helps translate raw sales numbers into meaningful data, enabling smarter decision-making and clearer communication of results.

- This is important for accurate financial reporting and compliance with…

How Matt Passed the CPA Exams in 5 Months with No Accounting Experience

The percentage of sales method formula allowance for doubtful accounts on the balance sheet is increased by credit journal entry. Accounts receivable represent amounts due from customers as a result of credit sales. Unfortunately for various reasons, some accounts receivable will remain unpaid and will need to be provided for in the accounting records of the business. The percent of sales method shows what percentage of your total revenue is made up by a particular number — like an expense, cost, or item line. By maintaining this ratio, the company can estimate the accounts receivable balance required to support future sales levels.

Yes, you can calculate percentage of sales for any time frame by using sales data from the specific period and comparing it to total sales within the same timeframe. For assets like accounts receivable and inventory, the percentage of sales indicates the proportion of sales revenue tied up in these assets. This assists in managing working capital and ensuring sufficient asset levels to support sales growth.

TS.BS Vũ Trường Khanh có thế mạnh trong điều trị một số bệnh Gan mật như:

- Gan nhiễm mỡ

- Viêm gan do rượu

- Xơ gan

- Ung thư gan…

Kinh nghiệm

- Trưởng khoa Tiêu hóa – Bệnh viện Bạch Mai

- Thành viên Ban thường trực Liên chi hội Nội soi tiêu hóa Việt Nam

- Bác sĩ đầu tiên của Khoa Tiêu hoá ứng dụng phương pháp bắn tiêm xơ tĩnh mạch trong điều trị xơ gan mạn tính

- Bác sĩ Vũ Trường Khanh tham gia tư vấn về bệnh Gan trên nhiều kênh báo chí uy tín: VOV, VnExpress, cafeF…

- Các kiến thức về thuốc điều trị viêm gan hiệu quả